irs tax levy program

Get Your Free Tax Review. Review Comes With No Obligation.

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Levy proceeds will be applied to your federal tax liability.

. End Your Tax Nightmare Now. Determine whether the IRS. You May Qualify For An IRS Hardship Program If You Live In New Jersey.

Ad You Dont Have to Face the IRS Alone. Prior to the levy the IRS will have issued a notice of intent to levy and notice of your right to a hearing about the levy. Tax Relief up to 96 See if You Qualify For Free.

The Federal Payment Levy Program is an automated levy program the IRS has implemented with the Department of the Treasury Bureau of the Fiscal Service since 2000. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. BBB Accredited A Rating - Free Consult.

In addition responsible officers. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. No Fee Unless We Can Help.

Yelp is a fun and easy way to find recommend and talk about whats great and not so great in Paterson and beyond. Ad End Your IRS Tax Problems. Dunigan IRS Levy Lawyers in Paterson reviews by real people.

Compare 2022s Best Tax Relief Companies to Help You Get Out of Taxes. Ad End Your IRS Tax Problems. A tax levy allows the IRS or state government to physically seize your property to satisfy that liability.

Get Your Maximum Refund. Failing to pay your owed. Ad Use our tax forgiveness calculator to estimate potential relief available.

Trusted Reliable Experts. When taxpayers do not pay delinquent taxes the Internal Revenue Service IRS can work directly with financial institutions and other third parties to seize the taxpayers. IRS levies and tax liens are different and should not be considered the same thing.

Affordable Reliable Services. Take Avantage of Fresh Start Options Available. Get the Help You Need from Top Tax Relief Companies.

You May Qualify for an IRS Forgiveness Program. Weve filed over 50 million tax returns with the IRS. An IRS tax levy is a legal seizure of your personal assets which are then used to settle a debt that you owe.

Well help you get the biggest refund the fastest way possible. Complied with select provisions of 26 United States Code 6320 and 6330 when taxpayers exercised their right to appeal the filing of a Notice of. Ad Remove IRS State Tax Levies.

Ad Owe the IRS. BBB Accredited A Rating - Free Consult. Before the IRS files a lien you will receive a tax notice or bill.

The FPLP is an automated system the IRS uses to match its records against those of the governments Bureau of the Fiscal Service to identify taxpayers with unpaid tax liabilities. Ad Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation. Irs levy - federal payment levy program fplp Tax Levy on Social Security and Other Federal Payments In July 2000 the IRS in conjunction with the Department of the.

Reduce Your Back Taxes With Our Experts. The IRS can also use the Federal Payment Levy Program FPLP to levy continuously on certain federal payments you receive such as Social Security benefits. What is an IRS Levy.

The IRS began sending out letters from the Automated Collection System function in June and restarted the income tax levy program in July. Ad We Can Solve Any Tax Problem.

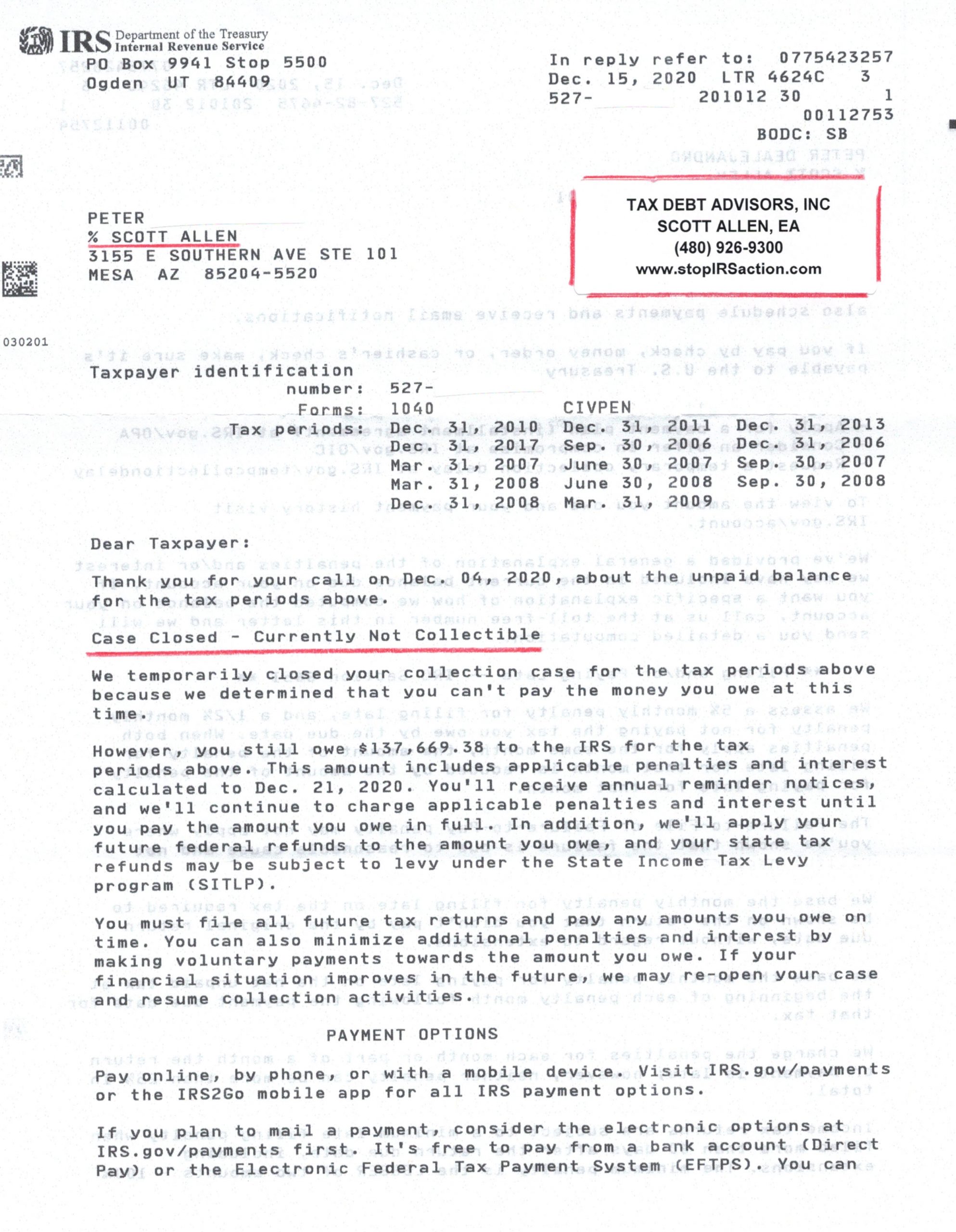

Glendale Az Irs Tax Attorney Or Tax Debt Advisors Inc Tax Debt Advisors

Irs Bank Levy Tax Center Usa Tax Problem Relief

Irs Has Restarted The Income Tax Levy Program

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Tax Levy Tax Law Offices Of David W Klasing

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Overview Of The Treasury Department S Federal Payment Levy And Treasury Offset Programs Everycrsreport Com

Irs Cp 508c Notice Of Certification Of Your Seriously Delinquent Federal Tax Debt To The State Department

Irs Audit Letter Cp504 Sample 1

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

5 19 9 Automated Levy Programs Internal Revenue Service

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Tax Levies Are Real Problems Requiring Professional Help

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block